ASIE 2017 Frequently Asked Questions

-

Question 1: Why does the ASIE even exist?

The confidential income and expense data collected in the ASIE is used to improve assessed values of all properties similar to yours. Your ASIE income and expense data is never used directly to value your property. Your data is added to all the data collected from the ASIE plus the data the Department of Assessment maintains on the physical attributes of all commercial properties to enrich statistical studies used to value all types of commercial property across Nassau County.

-

Question 2: I filed a ASIE 2015, do I have to start another account for the ASIE 2017?

No, if you started an account to file the ASIE 2015 or ASIE 2016 you may use that account to file the ASIE 2017.

Should you have any issues logging in, please contact us. -

Question 3: My property is 100% owner occupied, do I have to file the ASIE 2017?

YES. 100% owner occupied properties are not exempt from filing the ASIE 2017; however, you will not be asked any questions about your income or your expenses.

-

Question 4: Why do you need to know if I 'm 100% owner occupied?

Properties change hands, owner occupants become landlords. If your property were to become occupied by someone other than the owner, we need to know that and collect the income and expense to add to our database.

-

Question 5: I'm getting this message "A Filing has been started already for this Parcel":

This means someone else has started or completed a filing for this parcel. Please check with your accountant, attorney, property manager or any other party who may have filed on your behalf and resolve this conflict.

-

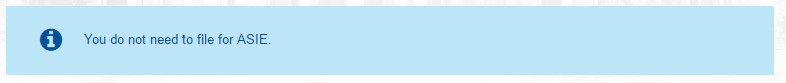

Question 6: I'm getting this message "You do not need to file for ASIE":

This means the parcel you have input is not a liable filer. Check that you are entering your section, block and lot correctly. Take your section, block, and lot from your ASIE announcement letter. As a double check you can also validate your parcel by street address. Additionally, check the class of the parcel. As of this writing only class 4 properties are required to file the ASIE 2017. It may also be that this lot is a parking lot; if that is the case please enter the improved lot (the one with the building) and add this lot as a contiguous lot.

-

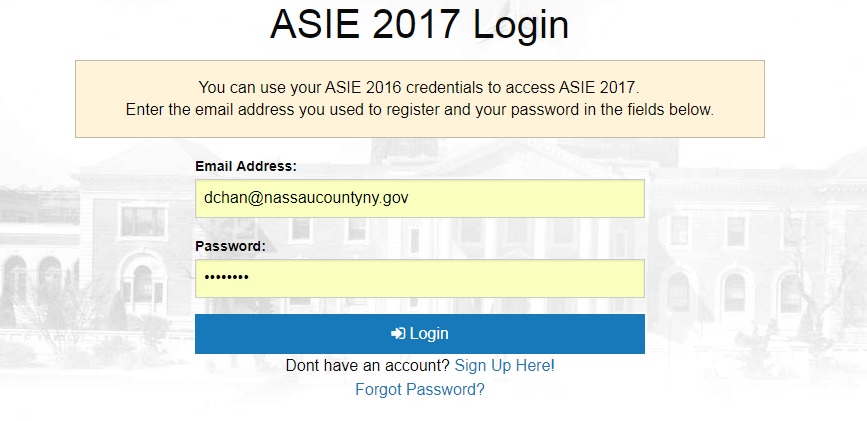

Question 7: I lost / forgot my password, now what do I do?

Use the "Forgot Password" tool on the ASIE 2017 login page. On the forgot password screen you 'll be asked to supply the email address you started your account with. You will receive an e-mail with a link to re-set your password. and you 're good to go. If you don 't receive the reset password in your inbox, please check your spam folder.

-

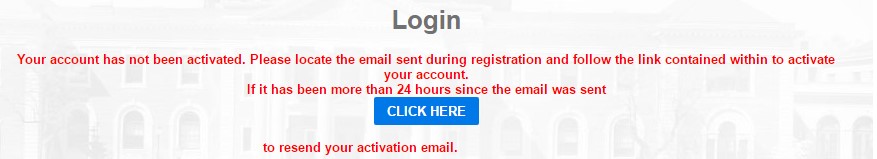

Question 8: I am being asked to activate my account, what do I do?

Click the on the button to start the activation process. An activation e-mail will be sent to your e-mail address. Click the link in the e-mail. That will activate your account. On that page there is a link to the login page.

-

Question 9: My property was under construction during 2017. Do I have to file the 2017 ASIE?

YES, just check the box "Properties that were UNDER CONSTRUCTION AND NOT LEASED IN 2017." This will bring you straight to the certification page.

-

Question 10: My commercial property does not produce any income, or operates at a loss, do I have to file the ASIE 2017?

Yes, you must file an ASIE 2017 regardless of the profitability of the commercial property.

-

Question 11: Why is there no spot for my Real Estate Tax expense?

We don’t ask for your Real Estate Taxes because we already have that data and we use it in building our valuation model.

-

Question 12: I purchased/sold my property in 2017 do I have to file the ASIE 2017?

The answer is yes; of course we won't ask you about your income and expense but, the sale date and sale price is important to us. After you supply that information and any change of mailing address you will be asked to certify your statements and that's it.

-

Question 13: My commercial property was 100% vacant for 2017, do I have to file the ASIE 2017?

The answer is yes; vacancy data is very important when building statistical models to assess commercial real estate. Be sure to indicate your vacancy in the appropriate field.

-

Question 14: What are reserves for replacements?

This is analogous to depreciation of equipment on a tax return. For the purposes of the ASIE reserves for replacement represents the amortized cost of short lived building components that will wear out before the building, for example: a new roof, resurfacing a parking lot, replacement of HVAC systems, upgrading network connectivity. If you replaced a roof for $20,000 and you anticipate it has a 15-year life, then 20,000 divided 15 = $1,333 (rounded) is the figure you 'd put in the reserves for replacement. Try to remember that figure for use in future ASIEs. Do not include painting, tape and spackle, changing of locks, new light fixtures, or any routine maintenance items in the reserve for replacement.

-

Question 15: Why don 't you want my mortgage expense (debt service)?

Your mortgage expense is the product of negotiation between you and your lender. It is not a reflection of your property's ability to earn income, nor is it an expense generated by the condition, location, age, maintenance or quality of the improvements.

-

Question 16: What is a contiguous lot?

A contiguous lot is a lot adjacent or in close proximity to the Primary Lot you started your filing with. A contiguous lot is part of the same real estate business entity and is possesses and interdependent relationship with the primary lot such that both lots are more valuable because of that relationship. Examples would be: A lot line running through an office building, a retail establishment on one lot and it's parking lot on an adjacent lot, an industrial building with employee parking on a lot across the street. Please put in all the lots associated with that particular real estate business.

-

Question 17: What is Ground Rent/ Ground Lease on the income page?

It is rent collected for the use of land under a building built by someone else. Typically, these are long term leases of 99 years. It might also mean rent collected for the use of land for outdoor storage.

-

Question 18: I 'd like a copy of my previous years ASIEs to follow. How do I get one?

Unfortunately, due to the confidential and sensitive nature of the data collected through the ASIE we cannot just produce a copy for you, even if you are the owner. Please address requests for copies of your ASIEs to:

Department of Assessment

ATTN: FOIL Officer

240 Old Country Road

Mineola, NY 11501 -

Question 19: My information hasn't changed from last year, do I still have to file?

You are required by law to file the ASIE every year.

-

Question 20: I own a specialty property. I used to have to file on paper. Can I file on-line now?

Yes, since the 2015 ASIE owners of specialty properties have been able to file on-line.

-

Question 21: Can 't I just send in my IRS forms / profit and loss statement / rent roll / ledger from my accountant?

No, in order for the data we collect to be usable it must be categorized as it is laid out on the ASIE form. ASIE law 6-30 states the county can only accept ASIE on county issued form and format.

-

Question 22: Can I continue I filing I left unfinished?

Yes, simply click on the Continue Filing link. Find the property you wish to continue filing and click on the white arrow in the blue box.

-

Question 23: Can I edit a form I 've already finished?

Sure, click on the View Completed Filing link. Then click on the Recall ASIE button. You will see this warning:

This is to let you know that by recalling your filing you are resetting your submission date; meaning if you were to edit your filing after the deadline date then that filing would be deemed un-timely and out of compliance, so use this for only serious changes. If you are making edits before the deadline click the Recall ASIE 2017 Filing. Then go to Continue a Filing and make your edit and Certify.

-

Question 24: What should be included in Contract Services?

Contract services are expenses incurred when employing outside service vendors retained for the maintenance of the real property on an annual basis. Contract services typically include, but are not limited to:

- Landscaping

- Garbage Removal

- Snow Removal

- Exterminator

- Maintenance of Sprinkler / Fire Suppression systems

- Maintenance of HVAC systems

- Office Cleaning

- Window Washing

- Plumbing

-

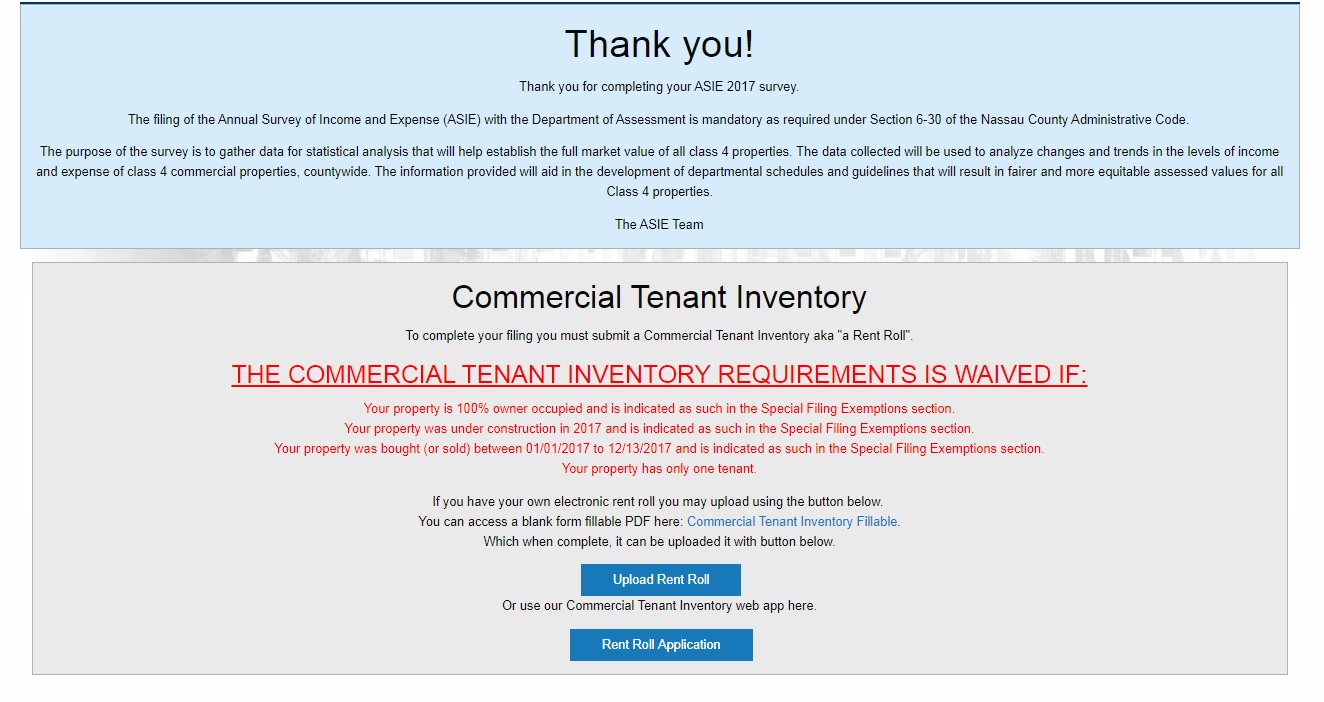

Question 25: Who has to file a Commercial Tenant Inventory?

If you were not owner occupied, under construction, or your property wasn't bought (or sold) in the calendar year of the survey OR you have more than one tenant you must file a Commercial Tenant Inventory. You will be brought to this page after certifying your filing:

Here you can enter a commercial tenant inventory, upload a digital file of your rent roll or download a .pdf to be uploaded when complete.

-

Question 26: I filed in 2013 and/or 2014. Do I need a new account login for 2017?

Yes. A new login ID and password was required for 2015. Your 2015 ASIE ID and password can be used for 2017. If you did not file 2015, you need to create a new User ID and Password.

-

Question 27: When is the last day to file?

Please note that the April 2, 2018 filing deadline is final.

-

Question 28: Do I need to create an account?

Your login ID and password is the same for the 2015/2016 of ASIE. If you did not file in 2015 or 2016, you need to create a new login and password.

-

Question 29: Where do I file my Rent Rolls?

You will be prompted to either upload your existing Rent Rolls or fill in the appropriate data on the County form at the end of the application process.

You can access a blank form fillable PDF here: Commercial Tenant Inventory Fillable. -

Question 30: What is the minimum browser requirements to run the electronic form?

We recommend the minimum requirement to be Internet Explorer 9, Firefox ver. 40, Google Chrome ver. 49, or Safari 5.

-

Question 31: How come I don't see my filing when I logged in?

Started SBL filings are connected to user's registered account.

**If you are from an origanization, please check to see if anyone else from your organization had already started the SBL filing under their account. Even if you are from the same organization, you cannot view their filings; only the account holder can access the started SBL filings.